We’re proud to be named

Small Practice of the Year 2025 at the Irish Accountancy Awards.

We’ve also moved to our new head office in Athlone.

Last updated: Dec 15, 2025

Ireland’s new Auto-Enrolment (AE) pension system begins in January 2026. This is one of the biggest changes to payroll in years, and it will apply to most employers. As always, Incorpro will handle all payroll calculations and AE setup, but here’s what you need to know now.

Who Will Be Automatically Enrolled?

Who Will NOT Be Auto-Enrolled?

What About Company Directors (Class S)?

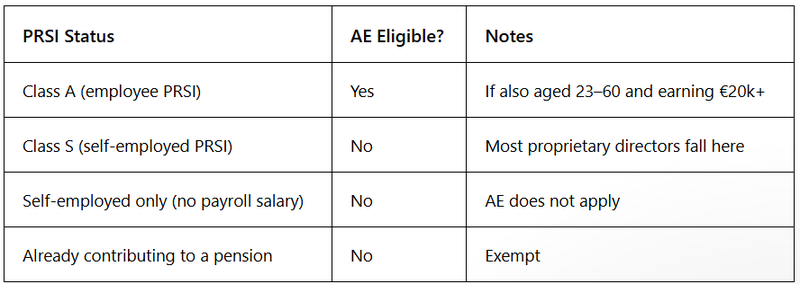

Based on a recent publication from the Department of Social Protection, our understanding is as follows regarding how Auto-Enrolment (AE) will apply to company directors when the new system begins in January 2026.

Will company directors be automatically enrolled? According to the Department’s guidance:

“If you pay PRSI as an employee and meet the eligibility criteria, then you will be enrolled.

But if you are registered as self-employed then you will not be eligible.”

gov.ie – Auto-Enrolment: Your Questions Answered

https://www.gov.ie/en/department-of-social-protection/publications/auto-enrolment-your-questions-answered/

Directors paying PRSI as employees (e.g., Class A)

They will be automatically enrolled, provided they are also:

These directors are treated as employees for AE purposes.

Directors registered as self-employed (Class S PRSI)

They will NOT be auto-enrolled.

Even if they take a PAYE salary, if their PRSI classification is Class S (self-employed) for that directorship, the Department’s interpretation is that they are not eligible for automatic enrolment under AE.

This applies to a large number of proprietary directors who are legally required to pay Class S PRSI due to their ownership/control of the company. Such directors may still contribute to a personal pension, but they are not automatically included in the State AE scheme.

Summary for Directors

How Employees Can Opt In (If They are Not Auto Enrolled)

If an employee is not automatically enrolled (e.g., under 23, over 60, or earning under €20,000), they can still opt in.

How it works:

No extra admin is required from the employer. Opt-in employees have the same rights and

contribution structure as those automatically enrolled.

What Employers Should Do During 2025

How Payroll Will Work in January 2026

Incorpro will share updates and support all clients to ensure a smooth transition. If you have questions or want to discuss how AE may affect your business or directors, feel free to get in touch.

Recent publications

Hi there 👋

How can I help you today?

For guidelines on using this chat, please refer to our privacy policy.