Last updated: Jan 19, 2024

Travel & Subsistence refers to the costs related to travel (e.g., fuel, public transport fares) and subsistence (e.g., meals and accommodation) incurred during work-related activities. Travel and Subsistence allowances are compensations for costs incurred by employees when carrying out their duties away from their normal workplace. These allowances cover transportation expenses and costs related to meals and lodging during business trips. Understanding the regulations, best practices, and compliance requirements is an important factor for both employers and employees in Ireland.

When it comes to reimbursing Motor Travel expenses tax-free, it's essential to understand that only those expenses incurred directly in the performance of work duties qualify. This means your daily commute to and from your regular workplace doesn't make the cut. Distinguishing between work-related travel and routine commuting is vital for accurate expense reporting and compliance with tax rules.

Figuring out your 'regular' place of work is more than just a logistical question. It’s where you typically perform your daily duties. For those without a fixed work location, like field engineers or sales reps, specific guidelines determine how travel expenses are handled. This is especially important as it influences how travel expenses are calculated and reported.

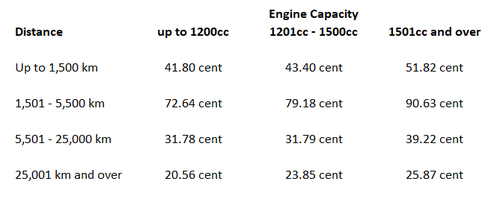

The Revenue Commissioners provide standard rates for calculating allowable Travel and Subsistence expenses. These rates are regularly reviewed and updated. Standard Motor Travel rates are carefully structured based on the vehicle's engine capacity and the distance traveled.

The following table illustrates the standard mileage rates for motor vehicles, as set by the Revenue Commissioners:

Claims made for journeys undertaken in electric vehicles should use the rates applicable to the category of 1,201cc to 1,500cc.

Reduced mileage rates apply for journeys associated with an official’s job but not solely related to the performance of those duties. Examples include necessary travel in relation to:

The shift towards remote working has brought new challenges in how travel expenses are viewed and reported. Understanding the tax implications of occasional travel to the office or other work-related locations is crucial for remote workers. If an employee works part-time in the office and part-time at home, her/his work base is the office. Expenses of travelling between an individual’s home and place of work may not be reimbursed tax-free. Likewise, subsistence expenses for periods spent in an individual’s home may not be paid without deduction of tax.

Do bear in mind that the Irish Revenue operates an administrative practice allowing employers to offer their employees a Remote Working Daily Allowance of up to €3.20 without the imposition of tax.

A day allowance applies to continuous absence of five hours or more, provided the absence is not at a place within 8 kilometres of the employee’s home or normal place of work. Domestic day subsistence rates (from 14 December 2023) are as follows:

The overnight allowance covers an overnight assignment of up to 24 hours. This must be at least 100km from the employee's home and their normal place of work. The rates for assignments within the state are as follows

For assignments over 56 nights, you must make an application to Revenue to confirm subsistence is still available.

Site-Based Employees (those whose work takes them to various locations) and Emergency Call-Outs (e.g. healthcare workers, who might need to respond to work emergencies) have their own unique rules that are not covered here.

Maintaining detailed records of Travel and Subsistence expenses is crucial for compliance. Employers and employees must keep all receipts and logs. This includes logging details like dates, destinations, distances, and the specific purpose of each journey. Accurate record-keeping is the backbone of compliant and efficient expense reporting, ensuring that each claim is justified and in line with company policies and tax regulations. Enhanced Reporting Requirements (ERR) mandate the accurate reporting of these expenses to the Revenue Commissioners.

Should you have any queries or require assistance with your Accounting and Tax needs, our dedicated team at Incorpro is here to help. Connect with us by calling 01-4429409, or visit our Contact Page for more ways to get in touch. Stay updated and engaged by following our Social Media Pages on Twitter, Facebook, LinkedIn and Instagram.

We value your feedback! If you are an existing customer and you enjoyed our service, please consider leaving us a review on Google or Trustpilot to share your experience with others. Your insights help us continuously improve and further enhance our services!

Recent publications

Hi there 👋

How can I help you today?